RUG-MAKING SUPPLIES - READICUT (Pt 3)

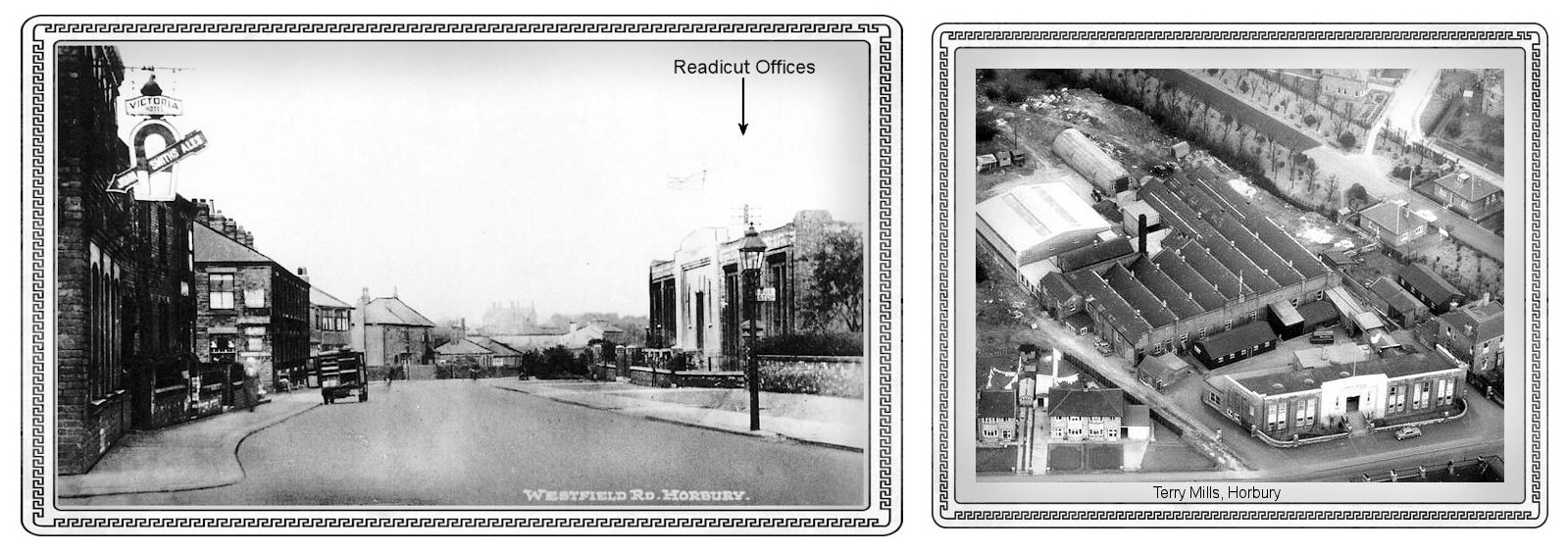

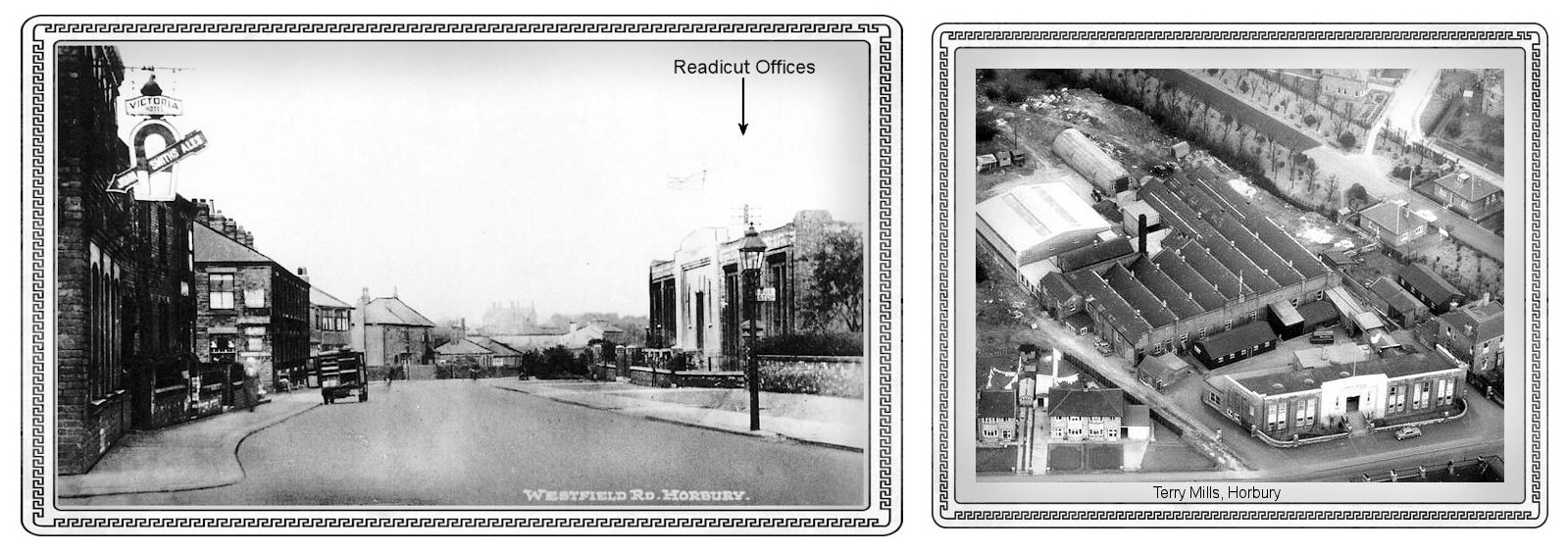

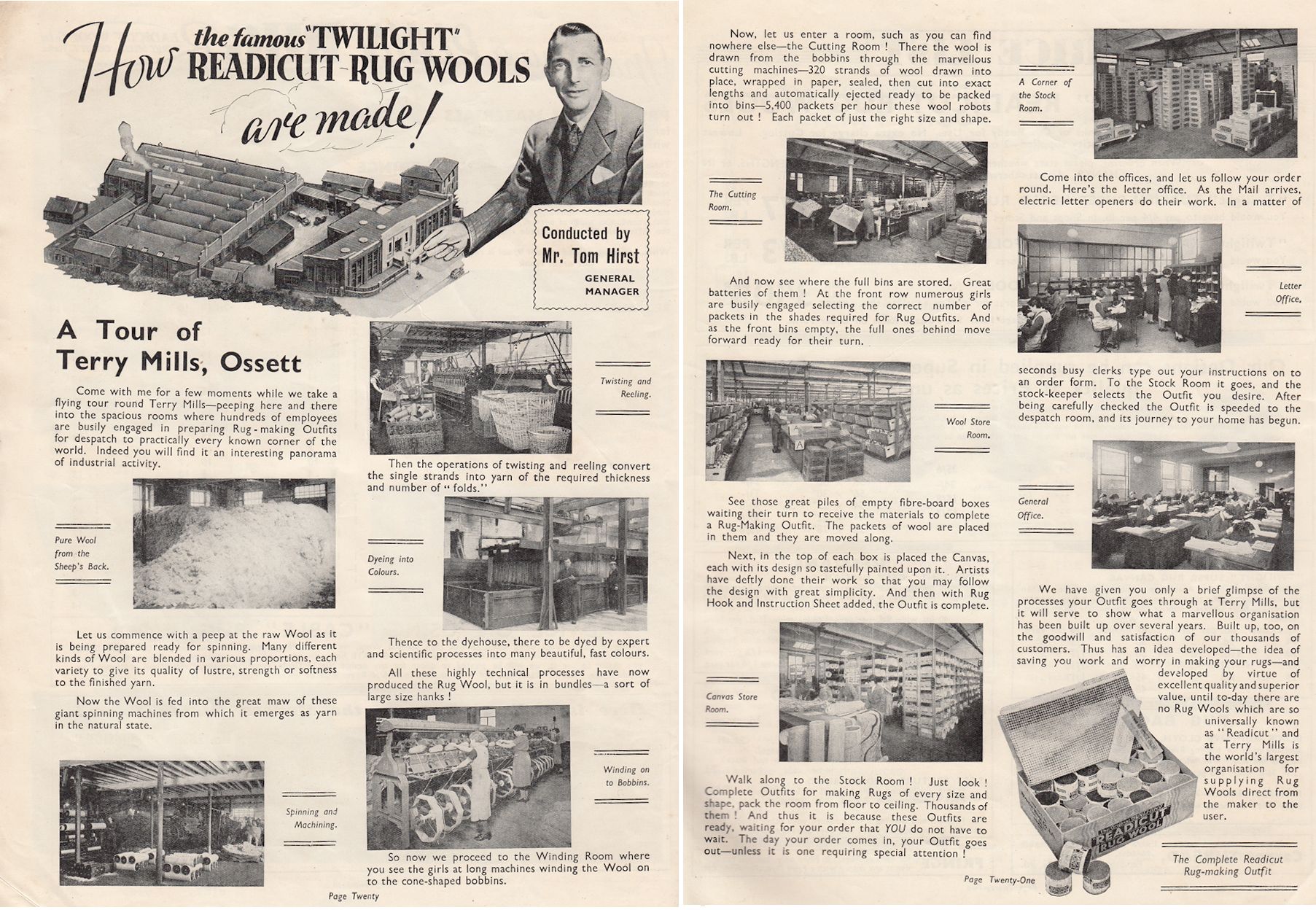

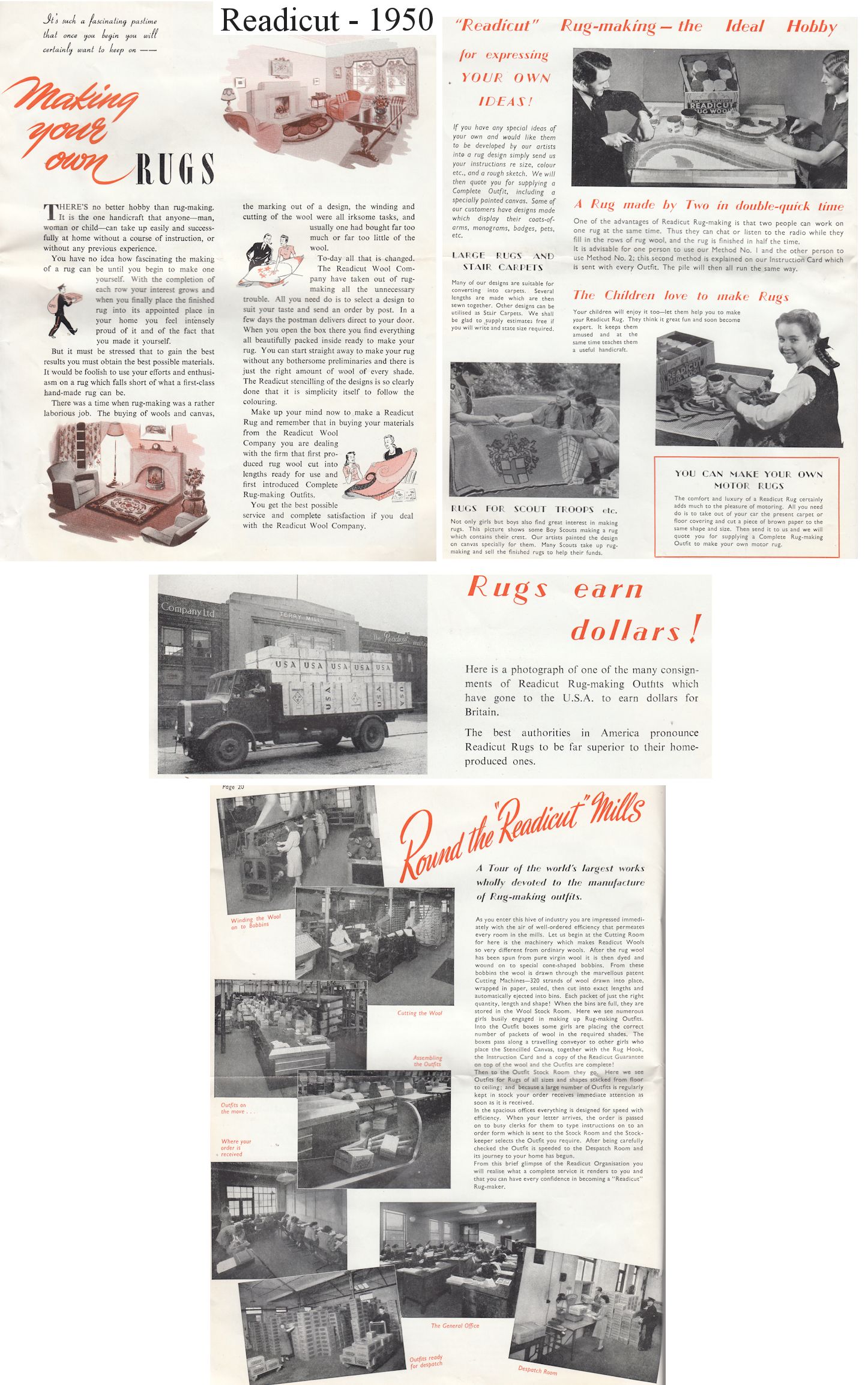

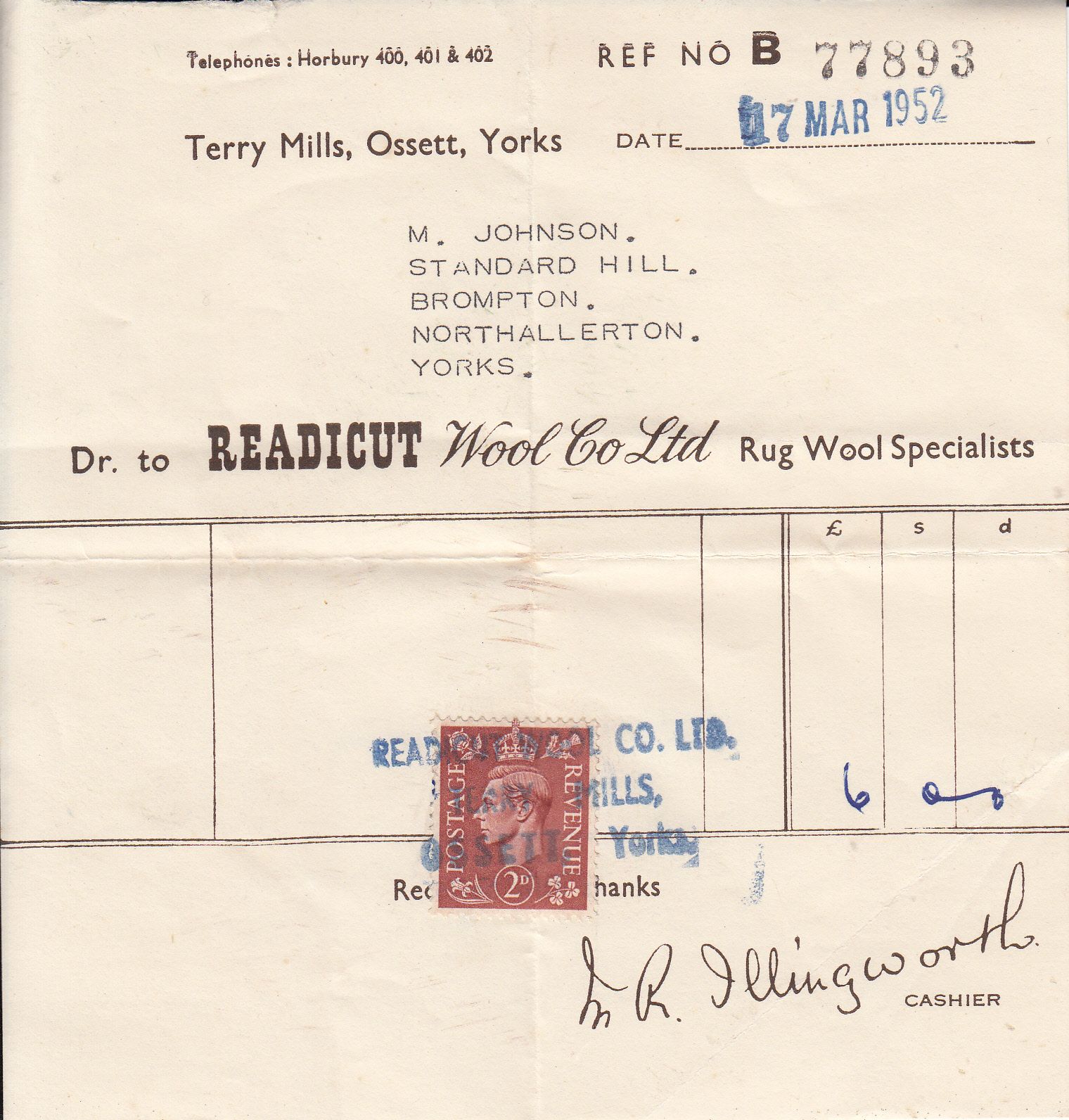

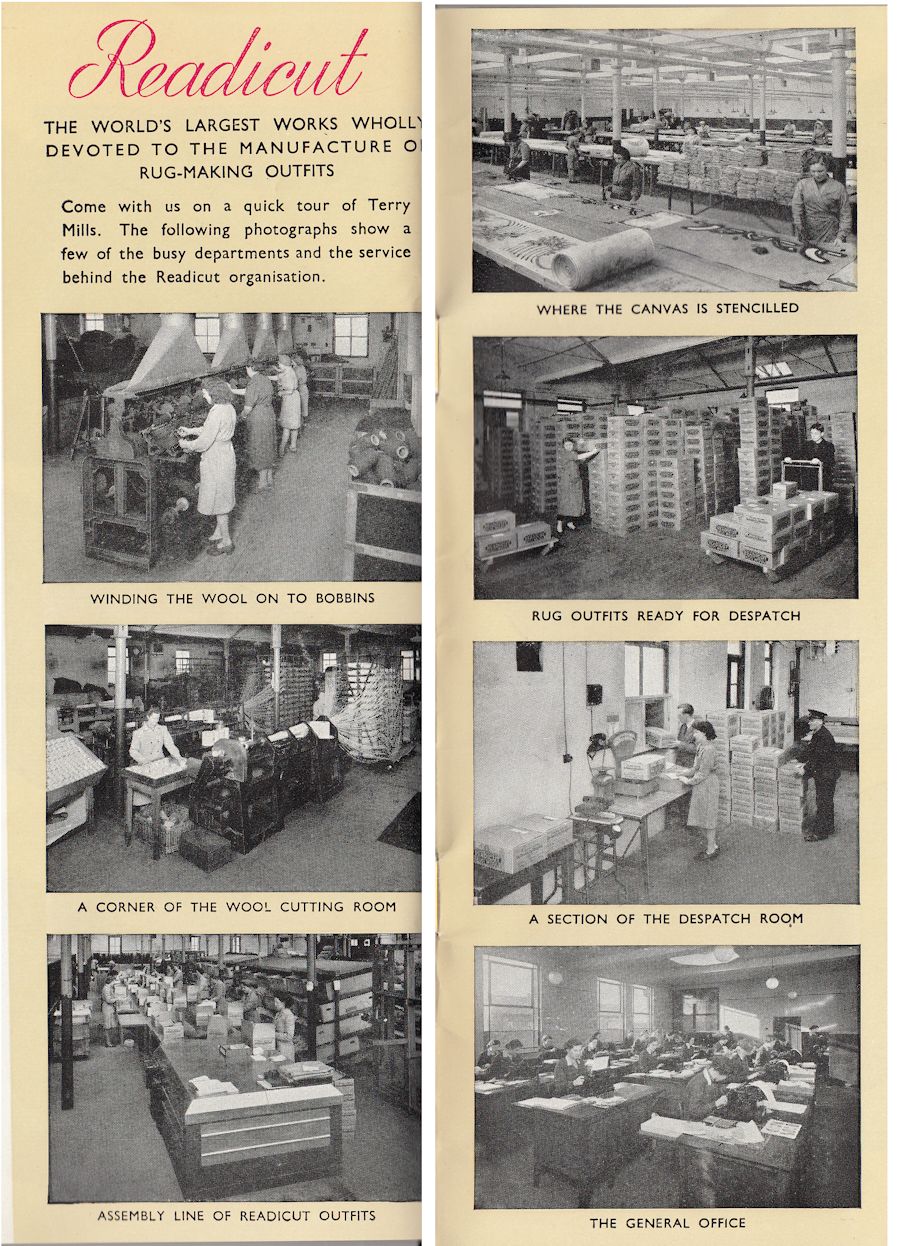

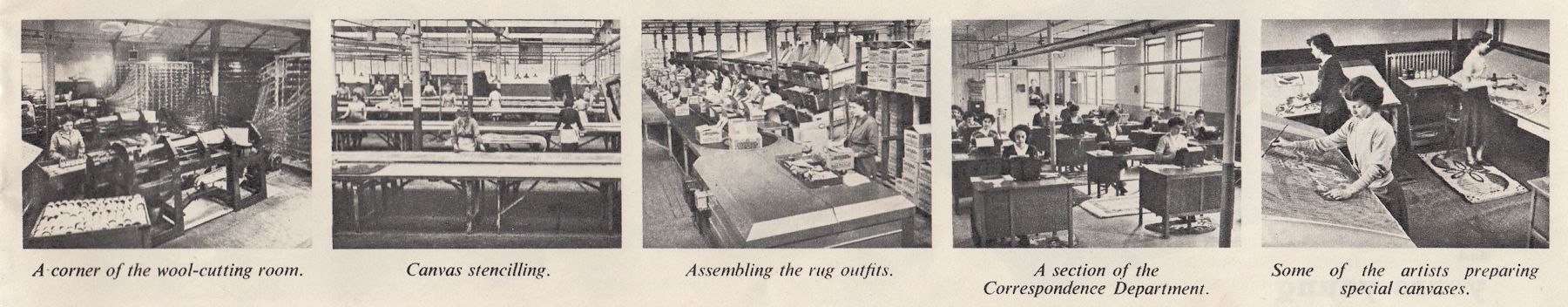

Part of the Readicut story – including their Annual General Meetings – is documented in newspapers from the Leeds area (the latest report available to me was 1955). There are also photographs from their own catalogues.

Leeds Mercury - 2 January 1934

OSSETT’S YEAR OF STEADY EXPANSION. People of Ossett, Horbury, Sillington, and district have had a distinctly better year than at any time since the industrial slump began. Though a good deal of unemployment still exists, there has been a gradual improvement over many months. [. . .] the Readicut Wool Company has grown from small beginnings to a large and prosperous concern. '

Yorkshire Post and Leeds Intelligencer - 14 November 1936

WOOLLEN RUGS. Leeds Publicity Club Address Mr. Arthur Collinson, Vice-Chairman, gave an address at a meeting of the Leeds Publicity Club last night, on the the growth of the Readicut " Wool Company, a West Riding firm. As tribute to the advertising power of English periodicals,he said the firm had received replies from almost every country in the world. A visitor from New Zealand made a journey from London to see the factory, and four South Africans came from Edinburgh where they were staying. In spite of all the present-day preference for weird furniture and furnishings, the best sellers in rugs were the most modest designs browns and fawns.

Sydney Morning Herald, 25 March 1939

This advert shows the extent of readicut's reach around the English-speaking world. Readicut Wool Co of Australia was based at St James Building, 109 Elizabeth Street, Sydney where there was a display of rugs. The rug outfits could not be bought from shops, but had to be bought from the factory representatives.

Daily Herald - 26 September 1939

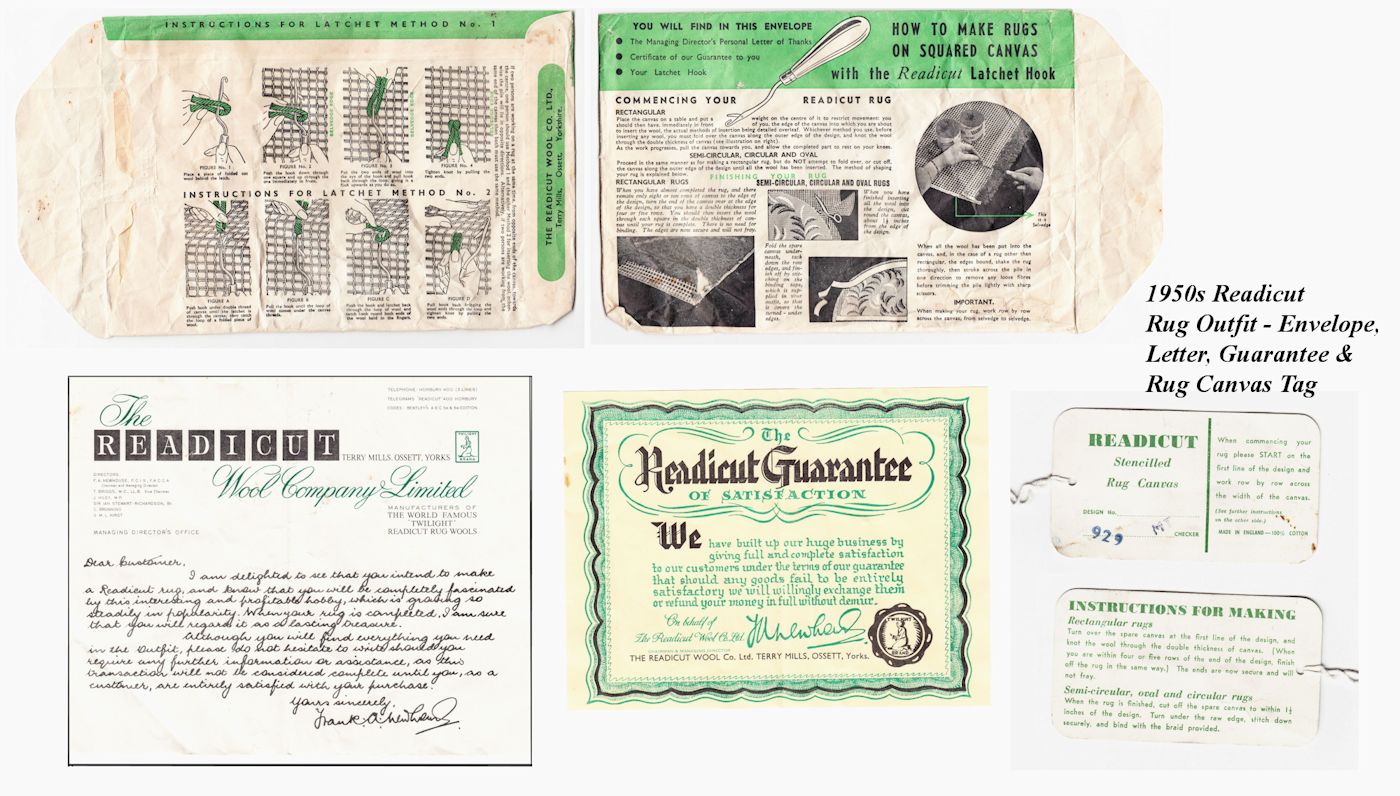

TAKE A TURN WITH THE RUG. EVENINGS grow longer and it is hard to keep the family entertained. Why not start a family rug? You will be surprised how quickly the canvas gets covered when many hands help. Choose a simple design in a suitable colour that fits into the decorative scheme and, believe me, sitting-room, hall or bedroom will be increasingly cosy by the addition of a new rug. One of the most popular designs is the sun-ray one. It is in lovely shades of orange and brown on a fawn ground. Ideal for a hearth-rug in a sitting-room. Another that caught my fancy for a children's bedroom had a couple of pussy-cats having forty winks on a neutral ground.

Correct Lengths. I need not emphasise how helpful it is having all the wool cut up into the correct lengths and done up in handy packets, so that not one inch need be wasted. Think of the time it saves, too. Cutting a quantity of wool to an exact length is a hand-aching job at the best of times. You understand, of course, that matching wools is not going to be easy in pre-war days. That is why it is essential to buy sufficient to complete the rug at one time.

It is so easy doing it the Readicut way, whereby canvas with colour marked design, hook, rug wool and instructions are obtainable together. Every woman would be interested in their new rug book, which not only shows two different designs, but also samples of wools are included. This book is priced at 1s„ but a copy will be sent free to any reader on application; 2d in stamps should be included for postage.

Leeds Mercury - 10 November 1939

For the housewife there is no more fascinating way of spending the evening at home than in rug-making. The Readicut Wool Co. Ltd of the County Arcade, Leeds, are making a special “blackout offer” of wools of mixed colours, all ready cut, and sufficient to make a rug 54 inches by 27 inches for twenty shillings. This company specialises also in knitting wools of all colours and has many original designs for rugs which customers can use.

Yorkshire Post and Leeds Intelligencer - 3 May 1949

RUGMAKING Demonstrator required by Readicut Wool Co., Ltd., who is prepared to travel and demonstrate at their retail branches; applicants must be proficient at making rugs on both hessian and canvas and be able to explain these methods thoroughly, good remuneration and travelling expenses will be offered to the lady chosen to fill this position.—Please forward details of experience and age, along with two recent references to Shops Manager, Readicut Wool Co. Ltd., Shops Dept., Westfield Mills, Ossett.

Yorkshire Post and Leeds Intelligencer - 5 May 1950

Estimate exceeded. Readicut. Ltd., the Yorkshire suppliers of worsted and woollen rug wools, were made public in May, 1949. A highly satisfactory preliminary statement is now Issued by the company for the period ended March 31 last. Against a prospectus estimate of £91,500, they report group profits of £169,000, subject to tax of £89.000. The net figure amply covers the dividend 15 of per cent recommended for the period. The 1 shilling shares closed to-day at 1s 8d, this price comparing with the placing price of 1s 4d. The yield on the shares is a shade over 9 per cent.

Yorkshire Post and Leeds Intelligencer - 23 June 1950

THE FIRST ANNUAL GENERAL MEETING OF READICUT LTD.. Mr. Ralph Hirst's statement. The first annual general meeting of Readicut Ltd. was held yesterday at the Queens Hotel, Leeds. The following is the statement by the Chairman and Managing Director, Mr. Ralph Hirst, which had been circulated with the report and accounts for the period to 31st March, 1950:

It will be recalled that your company was formed in May last year acquire the issued share capital of The Readicut Wool Company, Limited. The accounts of the holding company which are now presented therefore relate to the period May 20, 1949, to March 31, 1950, although the annexed consolidated accounts of the operating subsidiaries cover the complete year which ended on the latter date. Being the first accounts of the holding company, comparative figures are not given, but they will be Included in future.

I am sure you will ail pleased with the trading result, for the group profits before taxation at £168,719 are considerably in excess of £91,500, which was the directors' profit estimate in the public advertisement last May. The year's turnover constitutes a record and there never was shown a greater interest in our products by the purchasing public. Your directors are not unmindful of the very serious problems which accompany the continued advance in raw wool prices. For this reason, there has been created a stock contingencies reserve of £25,000. It has been decided to create a fund for the provision of pensions payable at the discretion of the directors to members of the staff who may retire after long service with the company or its subsidiaries. The sum of £5,000 has been set aside for this purpose.

Since the accounts are published with full explanatory notes, it is not necessary for me to go into them in detail. I therefore content myself with drawing your attention to the points already mentioned and the sound position revealed by the consolidated balance sheet, which shows our current assets exceed current liabilities by £223,021, and that in our current assets there Is £146,683 in cash.

Appropriation of profits. An interim Preference dividend of £1,260 net for the period May 1, 1949, to September 30. 1949, and an Interim Ordinary dividend of £5.500 net were paid during the year; the final Preference dividend of £1,513 net was paid on March 31. 1950. In the public advertisement, your directors proposed to recommend the payment of a dividend on the Ordinary shares at the rate of 15 per cent per annum, less tax, for the period of approximately ten months from the date of the acquisition of The Readicut Wool Company, Limited, down to March 31, 1950. i.e. a dividend of approximately 13 per cent, for the period of ten months. In view of the successful year's trading, your directors have recommended that in lieu of paying a final dividend of 8 per cent., which would have resulted in a total dividend for the months of 13 per cent., a final dividend of 10 per cent, should be paid.

Your directors are confident that the unexcelled service offered by your company, backed by its many years' experience in the trade, will enable it to maintain its position as the foremost company engaged in the sale of complete rug-making outfits. The shops department continues to expand, and during the last financial year another shop has been opened In Yorkshire to cater for our many customers in the Barnsley area. Since Melvar Printed Fabrics, Limited. was reorganised, new records have been established in the number of stencilled canvases produced, and altogether I can say that I am pleased, not only with the results to date, but with the prospects for the group and its ability to handle expanding business. You will know how vitally important it for the welfare of this country that we export to dollar countries; you will be pleased to learn that your directors have laid plans for an increased export trade to America, and we look forward with a certain degree of confidence to increasing our turnover under this heading in the comparatively near future.

I know that you will wish me to express your appreciation and that of your directors to all those employees, including executives, staff, workpeople and shop assistants, who have co-operated loyally to secure such satisfactory trading results

Adoption of the accounts. I now have in pleasure moving the following resolutions:—(1) That the directors' report and the accounts of the company for the period May 20, 1949, to March 31, 1950, be and they are hereby adopted. (2) That the payment by the directors of the following dividends during the year ended March 31, 1950, be and it is hereby confirmed:—(a) An interim dividend for the period ended September 30, 1949, on the Preference shares of 5 and one half per cent, per annum less tax, and final dividend thereon for the six months ended March 31, 1950, of 5i per cent, per annum less tax. (b) An interim dividend on the Ordinary shares of 5 per cent, actual, less tax. (3) That a final Ordinary dividend of 10 per cent, actual, less tax, be and it is hereby declared payable forthwith.

The report and accounts were adopted, the payment of the Interim Ordinary and Preference dividends and a final Preference dividend was confirmed and a final Ordinary dividend of 10 per cent, actual, less tax, as recommended, was approved.

The retiring director, Mr. T. Briggs, M.C., LL.B., was re-elected and the appointment of Messrs. Wheawlll and Sudworth auditors having been confirmed and their remuneration having been fixed the proceedings terminated with a hearty vote of thanks to the chairman.

Yorkshire Post and Leeds Intelligencer - 7 July 1951

Readicut profits jump. Once again Readicut, the Horbury (near Wakefield) makers and retailers of rug wools and outfits, who were made public in May, 1949, have done considerably better than the prospectus estimate. The dividend for the year ended March 31 last is raised from an annual rate of 18 per cent, to 20 per cent., while group trading profits are up from £169,000 to a record £229,000. Of this last sum tax takes £129,000 (against £89,000) but a sufficient sum remains to cover the increased dividend and to leave a good proportion of profits in the business. The dividend will cost only £21,000 net compared with £76,000 transferred to reserves and the carry forward. The company's 1 shilling ordinary shares yield nearly 12 per cent, at 1s 9d, cum the final dividend of 15 cent.

Yorkshire Post and Leeds Intelligencer - 11 August 1951

THE SECOND ANNUAL GENERAL MEETING OF READICUT LIMITED. The second annual general meeting of Readicut Limited was held yesterday at the Queens Hotel, Leeds. The following is the statement by the Chairman and Managing Director, Mr. Ralph Hirst, which had been circulated with the report and accounts for the year ended 31st March, 1951:-

Before I commence the usual business of the meeting, I have to announce that Sir Ian Stewart- Richardson, Mr. J. Jabez-Smith and Mr. F. A. Newhouse have recently been appointed directors of this company. The increasing work involved in conducting the affairs of your company has been shared hitherto by a comparatively small board, and with a view to overcoming this it has been decided to make these additional appointments, which require confirmation your hands today.

Accounts and trading profits. In presenting the accounts for the year ended 31st March. 1951, I am very pleased to report an increase In profit, before taxation, of £50,464 over that shown in the accounts submitted at the last annual general meeting. This may be considered extremely satisfactory, bearing In mind the many difficulties with which your company has had to contend during the past 12 months.

The group’s profits on the year's working amount to £229,183, and after providing £128,913 for taxation there remains a balance of £100,270 (against £79,289). After adding thereto the amount brought forward at 1st April, 1950, there remains available for distribution the sum of £118,835 (against £67,838). Your directors are concerned at the increasing cost of raw materials, which will inevitably have its effect on the selling price of the finished product, and the resulting increase in consumer resistance, and accordingly have thought it advisable increase the Stock Contingency Reserve by £50,000 to £75,000. As you will see, the accounts are published with full explanatory notes, and I do not therefore consider it necessary to go into them in more detail. I would, however, like to draw your attention to the fact that current assets exceed current liabilities by £326,460 (against £223,021).

Appropriation profits. Interim Preference and Ordinary Dividends of £1,512 net and £5,550 net respectively, and a Final Preference Dividend of £1,513 net were paid during the year. In considering the proposed Final Ordinary Dividend, your directors have been influenced by the necessity for consolidating the finances of the group and the Chancellor the Exchequer's request that moderation be exercised in dividend declarations. Having regard to the satisfactory results achieved during the year under review, however, they feel justified in recommending that a Final Ordinary Dividend of 15 per cent, actual (less tax) paid.

General. The conditions of the moment make it dangerous to indulge with confidence in forecasting prospects for the immediate future, taking into account the recent fluctuations in the price of wool. Despite all difficulties, however, your directors feel that your company will maintain its position as the largest company engaged in marketing complete rug making outfits, and to that end are constantly investigating new methods presenting its products to the public. The Shops Department, despite increasing difficulties, continues to operate successfully, and as occasion warrants additions will be made to the number of Readicut shops. Melvar Printed Fabrics Limited has expanded recently on the merchanting side, and the Mall Order Department has executed an increased volume of export orders during the year, not only to America, where your company's outfits are now being advertised on a substantial scale, but also to New Zealand, Australia, and, in fact, all over the world. Nevertheless, it is on the mail order sales in the home market that your company's prosperity primarily depends, and although during the current year it is doubtful whether the benefits derived from cheaply bought raw materials will be as great as during last year, every effort will continue to be made to introduce Readicut rugs into more and more homes. Finally, I would like to express to the executives, staff, workpeople and shop assistants, on behalf of your directors and myself, our appreciation of their services and cooperation, without which such satisfactory results would not have been possible.

Adoption of the accounts. I now have pleasure in moving the following resolutions:— (1) That the directors' report and the accounts of the company for the year ended 31st March, 1951, be and they are hereby adopted. (2) That the payment by the directors of the following dividends during the year ended March, 1951, and hereby confirmed:— (a) Interim and Final Dividends on the Preference Shares of 5 and one half per cent per annum, less tax, for the six months ended 30th September, 1950, and 31st March, 1951, respectively. (b) An Interim Dividend on the Ordinary Shares of 5% actual, less tax. (3) That a Final Ordinary Dividend of 15% actual, less tax, be and it is hereby declared payable forthwith.

The report and accounts were adopted, the payment the Interim Ordinary and Preference Dividend and Final Preference Dividend was confirmed, and a Final Ordinary Dividend of 15% actual, less tax, recommended, was approved.

The retiring directors, Mr. J. Hiley, Sir lan Stewart-Richardson, Bart., Mr. J. Jabez-Smith and Mr. F. A. Newhouse, were re-elected, and the remuneration of the auditors, Messrs. Wheawill and Sudworth, having been fixed, the proceedings terminated with a hearty vote of thanks to the chairman.

Yorkshire Post and Leeds Intelligencer - 23 November 1951

Readicut's lower interim. Further proof of the difficulties caused the wool textile Industry by the extreme fluctuations in wool prices comes from Readicut, the Horbury makers of rug wools and rugmaking outfits. The company have cut their interim dividend for the year ending March 31 next by 2 per cent, to 3 per cent. For 1950-S1 the full distribution of 20 per cent, was covered by earnings of 91.S per cent.

Yorkshire Post and Leeds Intelligencer - 8 May 1952

Readicut pay less. Readicut, the Horbury (near Wakefield), makers of rug wools, etc., are reducing their dividend for the year to the end of March last from 20 per cent, (a rate covered by 1950-51 earnings of over 90 per cent.) to 12 per cent. Group profits have slumped from £229,000 before tax of £129.000, to £62,000, subject tax of £39,000. The lower dividend has fair cover and the carry forward is raised by £7,000 to £52,000. On this occasion, however, there are no transfers to reserves: from the 1950-51 profit, £50,000 was allocated to stock contingencies. The results are unfortunately typical of the 1951 experience in the wool textile Industry. The trade is still suffering from the after-effects of the fluctuations in wool prices in 1951.

Yorkshire Post and Leeds Intelligencer - 31 May 1952

Fall in wool prices helps liquid assets. Full reports for the year ended March 31 last of three well-known Yorkshire wool textile companies, John Edward Crowther (Holdings), Readicut and R. Beanland and Co.. all bear the marks of the trade recession which has hit the West Riding. The fall in profits is serious enough but there is one encouraging feature in the accounts of several wool companies now being published. The slump in raw material prices has had the expected effect of releasing funds tied up in stocks at vulnerable price levels and of I Improving liquid positions which had become too thin for safety.

Tax cushion helps Readicut. Combined profits of Readicut, the Horbury (near Wakefield) specialists in rug wools, have fallen heavily from £229,000 to £62,000. The tax cushion provides useful relief: the tax charge is down from £129,000 to £39,000, and the net profit provides reasonable cover for the dividend of 12 per cent, against 20 per cent. Commenting on the outlook, the chairman. Mr. R. Hirst, notes that confidence in wool values is returning. He refers besides to the satisfactory financial position of the group whose ability to earn good profits in the future has not been Impaired by the difficult conditions of the past 12 months

Yorkshire Post and Leeds Intelligencer - 27 June 1952

THE THIRD ANNUAL GENERAL MEETING OF READICUT LIMITED. Satisfactory financial position. The third annual general meeting of Readicut Ltd. was held yesterday at the Queens Hotel, Leeds. The following is the statement by the Chairman and Managing Director, Mr. Ralph Hirst, which had been circulated with the report and accounts for the year ended March 31, 1952:

Accounts and trading profits. Although some of you may consider the results for the year ended March 31, 1952, to be comparatively disappointing, I am sure that, upon reflection, and bearing in mind the continued and much publicised depression in the textile Industry, you will readily understand why there has been a recession in the profits earned.

The group profits, before taxation, of £61,926, compare with the figure of £229,183 for the previous year, but this latter figure was due to abnormal circumstances. Had unavoidable stock losses not been charged against the trading profits for the year under review, the net profit earned would have been considerably higher. I feel, therefore, that the accounts show results which may be considered satisfactory, particularly as no call has been made on the stock contingency reserve, although all our stocks were valued at cost or market value, whichever was the lower, on March 31 last. After providing £39,050 for taxation, the balance of profits remaining totals £22,876 (against £100,270). To this figure should be added the amount of £44,560 brought forward at April 1, 1951, resulting in the amount of £67,436 (against £68,836) being available for distribution.

Your directors are satisfied that your company is in a satisfactory financial position to take advantage of any increase in trade which may result when consumer resistance to buying is reduced. Due to the good profit record over the standard years, it is not expected that the available profits In the future will seriously affected by the Excess Profits Levy.

Appropriation of profits. During the year, interim Preference and Ordinary dividends of £1,444 net and £3,150 net respectively, and a final Preference dividend £1,444 net were paid. Your directors now recommend a final dividend on the Ordinary shares of 9% actual, less tax, which absorbs £9,450. compared with £15,750 absorbed by the final Ordinary dividend of actual, less tax, declared last year, leaving £51,948 to be carried forward to the credit of profit and loss account - an increase of £7,388

General . In my statement made to the shareholders on the occasion of the last annual general meeting, I expressed doubts to whether the benefits derived from the then cheaply bought materials would be as great during the period under review as during the previous year. Events have proved my doubts to have been correct, as comparison of the profits earned will show, but as there has been some evidence during recent months of returning confidence in wool prices. I feel justified in viewing your company's future prospects with cautious optimism, confident in the knowledge that your company's ability to earn good profits In the future has not been impaired by the difficult conditions of the past 12 months.

You will pleased to know that the mail order department, the shops department, and Melvar Printed Fabrics Ltd. have all operated at a profit during the year, and it has not been found necessary to dispense with the services of any of the staff, who have been fully employed at all times. The view might be taken that the present time is not politic for extending the scope of your company's activities, and whilst this may true in relation to the marketing of goods alien to those in which your company does business, your directors are firmly convinced that a progressive policy must maintained: to that end, they are constantly striving to add to the number your retail shops, and are making new and valuable contacts abroad. Finally, I should like once again to thank the executives and all employees, whose efforts have been stimulated by the difficult times through which we have been passing. I am particularly grateful to my colleagues on the board for the very full.support they have generously given at all times.

Adoption of the accounts. I now have pleasure in moving the following resolutions: That the directors’ report and the accounts of the company for the year ended March 31, 1952 be and they are hereby adopted. (2) That the payment by the directors of the following dividends during the year ended March 31, 1952 be and it is hereby confirmed: (a) Interim and final dividends the Preference shares of 5 and one half % per annum, lass tax, for the six months ended September 30, 1951, and March 31, 1952 respectively. (b) An interim dividend on the Ordinary shares of 3% actual, less tax. (3) That a final Ordinary dividend of 9% actual, less tax, be and is hereby declared payable forthwith.

The report and accounts were adopted, the payment of the Interim Ordinary and Preference dividend and of a final Preference dividend was confirmed, and a final Ordinary dividend of 9% actual, less tax, recommended and approved. The retiring directors, Mr. E. Brunning and Mr. T. Briggs were re-elected, and the remuneration of the auditors, Messrs. Wheawill & Sudworth, having been fixed, the proceedings terminated with hearty vote of thanks to the chairman.

Yorkshire Post and Leeds Intelligencer - 20 June 1953

THE FOURTH ANNUAL GENERAL MEETING OF READICUT LTD. The Fourth Annual General Meeting Of Readicut Ltd. was held on June 19 at the Queens Hotel, Leeds. The following is the statement by the Chairman, Mr. Eugene Brunning. C.B.E., which had been circulated with the Report and Accounts for the year ended March 31, 1953. It was with very great regret that, on December 31, your board received notice of the resignation from the chairmanship and board of your company of Mr. Ralph Hirst, who founded the group's chief trading subsidiary 25 years ago. My co-directors have elected me chairman, and I shall do all in my power to carry out my additional responsibilities to your satisfaction.

Accounts and trading profits. Despite the striking contrasts in trading conditions which have existed during the year ended March 31, 1953, I think you will agree that the trading results for the year are satisfactory, revealing, as they do, a substantial Increase in profits. The group profits, before taxation of £122,525, compare with the figure of £61,926 for the previous year, an increase of £60,599. After providing £68,760 for taxation, the balance of profits remaining Is £53,765 (against £22,876), and by adding to this figure the amounts of £51,948 brought forward at April 1, 1952, and £7,962, excess provision for taxation, a total of £113,675 becomes available for distribution, compared with £67,436, last year.

The satisfactory financial position of your company may be judged from the fact that current assets exceed current liabilities by £351,303, and your directors have every confidence in your company's ability to tackle the difficulties which seem likely to arise during the present financial year.

Appropriation profits. During the year, Preference dividends of 5 and one half % and an Interim Ordinary dividend of 3% were paid. Your directors, influenced by the more satisfactory results achieved, now recommend a final dividend on the Ordinary shares of 9% actual, less tax, and, in addition, a bonus thereon of 3% actual, less tax. To provide for these dividends, £45,806 of the profits earned have to be set aside; the Profits Tax charge amounts £10,306, Income Tax deducted to £16,262, leaving £19,238 for distribution. The profits retained in the group have been increased during the year by £42,489, making the balance on profit and loss account carried forward to next year £94,437.

General. At the commencement of the financial year under review, quotations for a good 64 shillings "B" quality tops were at the lowest level since the last quarter of 1949, and were considerably lower than the peak of the first quarter of 1951. Prices have taken an upward turn during the year, however, and although there was a slight recession July, this upward tendency has been maintained, with the result that wool prices have now reached a level at which it is difficult to pass on the increased cost to the consumer and, at the same time, maintain the volume of sales. I do not, therefore, subscribe to the views of those who take an easy, optimistic view of the possibilities for trading in the approaching season; nevertheless, I am confident of your company's ability to take every advantage of all opportunities for expansion open to it. You will no doubt be pleased to learn that, once again, Melvar Printed Fabrics Ltd., and the mail order department have had a successful year, the latter having dealt with a greater number inquiries from prospective customers than for many years past, a pleasing indication of the increasing interest being taken in Readicut home rug-making. A cautious, progressive policy continues to be maintained in respect of shops department. As regards export trade, your company suffered, as did many others, from the import restrictions imposed in a number of its foreign markets, but the Increased advertising of your company's products abroad will, I am sure, be of great benefit ultimately.

An annual tribute to the staff is expected of a chairman, but it is in all sincerity that I conclude by expressing my deep appreciation of the able, loyal, and enthusiastic services rendered during the year by the executives, the staffs at both of the company's mills, and all shops department employees.

Adoption of the Accounts. I now have pleasure in moving the following resolutions:- (1) That the directors' Report and the Accounts of the company for the year ended March 31, 1953, be and they are hereby adopted. (2) That the payment by the directors of the following dividends during the year ended March 31, 1953, be and it is hereby confirmed:- (a) Interim and final dividends on the Preference shares of 5 and one half % per annum, less tax, for the six months ended September 30, 1952, and March 31, 1953, respectively. (b) An Interim dividend on the Ordinary shares of 3% actual, less tax. (3) That a final Ordinary dividend of 0% actual, less tax, be and it is hereby declared payable forthwith. (4) That a bonus of 3% actual, less tax, be and it is hereby payable forthwith on the Ordinary shares.

The Report and Accounts were adopted, the payment of the interim Ordinary and Preference dividends and of the final Preference dividend was confirmed, and a final Ordinary dividend of 9% actual, less tax, together with a bonus of 3% actual, less tax, on the Ordinary shares, recommended, was approved.

The retiring directors. Mr. J. Hiley and Mr. F. A. Newhouse, F.CJ.S.. F.A.C.C.A., were re-elected, and the remuneration of the auditors, Wheawill and Sudworth, having been fixed, the proceedings terminated with a hearty vote of thanks to the chairman.

Yorkshire Post and Leeds Intelligencer - 26 May 1954

Readicut raise dividend. In the year ended March 31, 1954, the Readicut Wool Company, the Horbury (near Wakefield) makers of rug wools and rug-making outfits, earned consolidated gross profits of £157,000, against £123,000 Tax took £86,000, leaving net £71,000 against £54,000, so that the distribution of 20 per cent, (against 15 per cent.) remains a conservative payment. Group finances are robust with liquid funds amounting to £367,000 and reserves totalling £372,000, excluding the stock contingencies reserve of £75,000. Commenting on the outlook, the company’s chairman (Mr. E. Brunning) states that trade recession fears apart, the company’s directors view the future with confidence. It is, however, essential that the price of wool shall not fluctuate violently.

Yorkshire Post and Leeds Intelligencer - 18 June 1954

THE 5TH ANNUAL GENERAL MEETING OF READICUT LIMITED. The 5th Annual General Meeting of Readicut Ltd. was held at the Queens Hotel, Leeds, Mr. Eugene Brunning, C.B.E., the Chairman, presiding. The following is his statement circulated with the Report and Accounts for the year ended March 31, 1954.

Twelve months ago I expressed confidence in your company's ability to tackle the difficulties which seemed likely to arise during the financial year under review. It now gives me very much pleasure to present the accounts for the year ended March 31, 1954, reflecting, as they do, another year of successful trading, and proving that that confidence was justified. You will see that the accounts are published with full explanatory notes, and I assume, therefore, that you will not require me to discuss them in detail. However, mention should be made of the fact that the balance sheet discloses a strong liquid position, and reveals ample resources for the future development of your company.

Appropriation of profits. During the year under review, Preference dividends of 5 and one half per cent, and an interim Ordinary dividend of 3 per cent, were paid. Having regard to the satisfactory results achieved during the year, your directors, fully aware of the necessity for retaining adequate liquid resources to finance future expansion, but nevertheless, not unmindful of the right of shareholders to an increased reward from the higher profits, feel justified in recommending a final dividend on the Ordinary shares of 9 per cent, actual, less tax, and, in addition, a bonus of 8 per cent, actual, less tax. To provide for these dividends it is necessary to earn profits of £65.000; the Profits Tax payable on this sum amounts to £10,725, Income-Tax to £29,250, leaving a net amount of £25,025 for distribution to the shareholders. Taking into account an amount of £4.560 relating to E.P.T. Post-War Refund, the balance on profit and loss account has been increased during the year by £50,804, to a figure of £145,241, from which £100,000 has been transferred to general reserve, making the balance on profit and loss account carried forward to next year £45,241.

General. As the results show, trading conditions during the year under review have been reasonably satisfactory; if these are to be maintained, it is essential that the price of raw wool should not fluctuate violently. As to the future, from the sales held in the primary markets during last season there was little or no evidence of conditions which would enable a general reduction in rug wool prices to be put into effect, which is a pity, since there is little doubt that such a reduction would lead to an increased volume of business. However, the present level of purchasing power in the home market is comparatively high, and your company, which has consistently preserved the excellent quality of its products, is well placed to benefit from the increasing interest being exhibited in home rug-making. Your directors, therefore, whilst not unmindful of the oft expressed fears of a general trade recession, view future prospects with confidence, and will continue to explore new avenues for the expansion of the company’s business.

Both Melvar Printed Fabrics Ltd. and the Mail Order Department operated at full capacity during the year, whilst the Shops Department has recently extended its activities into Lancashire. With regard to export trade, an increasing volume of business is being done with our established markets abroad, the number of enquiries received during the past year constituting a record in the history of your company, and new and valuable foreign contacts have been made. Finally, we have a most loyal and efficient staff, and I welcome this opportunity of paying tribute to their enthusiastic efforts, without which such satisfactory trading results could not have been achieved.

The Report and Accounts were adopted, payment of an Interim Ordinary and Preference dividend and of the final Preference dividend was confirmed, and the final Ordinary dividend of 9 per cent, actual, less tax, together with a bonus of 8 per cent, actual, less tax, on the Ordinary shares, as recommended, was approved. The retiring directors, Sir lan Stewart-Richardson and Mr. J. Jabez- Smith, were re-elected, and the proceedings terminated with a hearty vote of thanks to the chairman.

Yorkshire Post and Leeds Intelligencer - 2 October 1954

Mr Ralph Hirst has been appointed a director of Readicut, the Horbury, near Wakefield, suppliers of rug wools, etc., and Mr. P. A. Newhouse has been made managing director.

Yorkshire Post and Leeds Intelligencer - 3 May 1955

Rug wool company again pays more. Readicut profits rise . For the third year in succession the dividend on the Ordinary sharesof Readicut has been raised. Today the directors announced a final of 12 per cent, for the twelve months ended March 31 last and a cash bonus of 10 per cent., to make a total of 25 per cent. This is 5 per cent more than was paid for the previous period which, in turn, was 5 per cent above the distribution made for 1952-53. This Horbury (near Wakefield) business, which specialises in the supply of worsted and woollen rug wools suitably prepared for home rug making, seems to have operated to full capacity, judging by the further expansion of profits, although it probably has derived some benefit from the recent extension of the activities of the shops department into Lancashire.

In any case, group profits of £194,559, which compare with £157,313 for the previous year, must be considered very satisfactory. After providing for all charges the consolidated net revenue is £95,251; an improvement of £24,000 on the year, it is within £5,000 of the record total reached four years ago. The directors do not propose to make any transfer to specific reserves, but the balance to be carried forward has shot up from £45,241 to £108.867.

Yorkshire Post and Leeds Intelligencer - 24 June 1955

THE 6TH ANNUAL GENERAL MEETING OF READICUT LTD. The 6th Annual General Meeting of Readicut Limited was held yesterday at the Queens Hotel, Leeds, Mr. Eugene Brunning, C.B.E., the Chairman, presiding. The following is his statement, circulated with the Report and Accounts for the year ended March 31, 1955.

Accounts and trading profits. In presenting the accounts for the year ended March 31, 1955, it is my pleasure in once again reporting an increase in trading profits, from £157,313 in 1954 to £194,559 in 1955. This increase is due to the fact that for the year under review both the Mail Order Department and Shops Department achieved turnovers which were records in the history of your company. Since full explanatory notes are published with the accounts, I assume that you do not require me to comment in detail on the latter, but I should like to draw your attention to the sound position disclosed by the consolidated balance sheet, which shows that current assets exceed current liabilities by £483,144 and that resources for the future development of your company are readily available.

Appropriation of profits. The trading profits for the year amount to £194,559, compared with £157,313 in 1954, which results in an increase in the amount of taxation payable, from £86,044 to £99,308 - the latter being equivalent to approximately 51 per cent of the trading profits - and leaves a profit, after taxation of £95,251, compared with the corresponding figure of £71,269 for 1954. Preference dividends of 5 and one half per cent, and an interim Ordinary dividend of 3 per cent, have already been paid, and your directors now recommend a final dividend on the Ordinary shares of 12 per cent, actual, less tax, together with a bonus of 10 per cent, actual, less tax; if this recommendation is approved, the balance on profit and loss account to be carried forward will total £108,867, an Increase of £63,626 over the amount brought forward from last year.

General. During the year concerned, your directors have spared no effort to make the name of your company a household word, both by advertisements in the national Press and by the use of other forms of publicity. From the results achieved, is clear that their efforts have not been without a measure of success. Throughout the period there has been a keen demand in the world markets for wool, and, in particular, for crossbred wool, with which your company is chiefly concerned; compared with the position a year ago, merinos have tended to become cheaper, but the price of crossbreds has risen. Your company was able to avoid raising prices to the public, a course which at all times it is reluctant to pursue, by the application of the most rigorous control to expenditure, but nevertheless quality has been maintained; I feel it incumbent on me to mention, however, that unless the increase in the price of the raw materials used in your company’s products is arrested, consideration will have to be given to an increase in selling prices, which course of action may lead to a certain amount of consumer resistance, with an inevitable adverse effect upon turnover.

I am pleased to report that all sections of the business operated successfully during the year under review, and your board is actively engaged both in extending the activities of the Mail Order Department and in increasing the number of units operated by the Shops Department. As regards export markets, although business in America and Canada has been on an increasing scale, the same tendency has not been apparent on the Continent, where, despite the efforts made to increase trade, a number of adverse factors have combined to make this extremely difficult. However, the position is constantly under review.

Turning to the future, perhaps it is premature for me to venture a forecast on prospects for the present year, but provided both national employment and purchasing power are maintained at their present levels, I have no reason to doubt that your company will continue to operate successfully. Finally, I cannot conclude my general remarks without paying a warm tribute to my co-directors, and especially the management, staff and workpeople, for their loyalty and co-operation during the past year; the success of your company is undoubtedly greatly due to their untiring efforts.

The Report and Accounts were adopted, payment of an interim Ordinary and Preference dividend and of the final Preference dividend was confirmed, and the final Ordinary dividend of 12% actual, less tax, together with a bonus of 10% actual, less tax, on the Ordinary shares, as recommended, was approved. The retiring directors, Mr. Brunning, Mr R. Hirst and Mr. T. Briggs, were re-elected and the proceedings terminated with a hearty vote of thanks to the chairman.

You are visitor number: